Evolution of the Mutual Fund Industry in India

Evolution of the Mutual Fund Industry in India

The concept of mutual funds was invented in Europe in early 1770s. During a bleak economic situation, Adriaan Van Ketwich, a Dutch merchant created the world’s first mutual fund in 1774. He pooled money from several individuals and created a diversified fund of bonds. He named it “Eendragt Maakt Magt,” which translates to “Unity Creates Strength.” The issue was successful and Van Ketwich introduced his second fund, “Concordia Res Parvae Crescunt” in 1779 with more freedom in investment policy.

Van Ketwich’s fund survived until 1824. But the vehicle he created is still considered to be a hallmark of personal investing more than two centuries later. The early mutual fund bouquet was close-ended in nature. It spread from the Netherlands to England and France before heading to the U.S. in the 1890s.

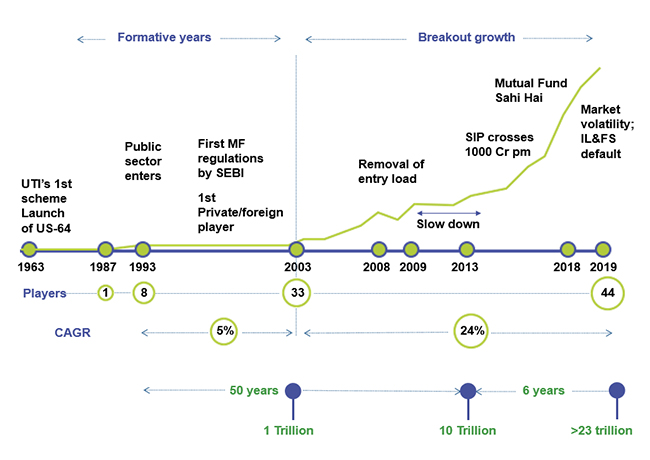

The Indian mutual fund industry started in 1963 with the formation of the Unit Trust of India (UTI). It was a joint initiative by the Government of India (GOI) and the Reserve Bank of India (RBI). The history of mutual funds in India can be segregated into four distinct phases

Phase I (July 1964 - November 1987): UTI All The Way

- UTI started its operations in July 1964

- The first & the most popular product launched by UTI was Unit64, with an initial capital of Rs 5 crore, which attracted the largest number of investors in any single investment scheme over the years

- In 1978, UTI was de-linked from the RBI and the Industrial Development Bank of India (IDBI) took over. It marked the introduction of open-ended growth funds

- At the end of 1988, UTI had Rs. 6,700 crores of Assets Under Management (AUM)

Phase II (November 1987 - October 1993): Entry Of Public Sector Mutual Funds

- Non-UTI, public sector mutual funds entered the market in 1987. These were set up by public sector banks, LIC and GIC

- SBI Mutual Fund was the first non-UTI Mutual Fund established in June 1987. It was followed by Canara Bank Mutual Fund in December 1987.

- At the end of 1993, the mutual fund industry had assets under management of Rs 47,004 crores

Phase III (October 1993 - February 2003): Private Players Enter The Scene

- During 1993-94 Kothari Pioneer Mutual Fund, ICICI Mutual Fund, 20th Century Mutual Fund, Morgan Stanley Mutual Fund and Taurus Mutual Fund launched their respective schemes

- During 1995-96, the industry witnessed a decline. A lack of performance of PSU Funds and miserable failure of foreign funds like Morgan Stanley eroded the confidence of investors in fund managers

- At the end of January 2003, there were 33 mutual funds with total assets worth Rs. 1,21,805 crores

Phase IV – (Since February 2003): UTI’s Restructuring And Beyond

- UTI was bifurcated into two separate entities. The specified undertaking of the Unit Trust of India, representing the assets of US 64 schemes, assured returns and certain others and the UTI Mutual Fund, sponsored by SBI, PNB, BOB and LIC

- The industry also witnessed several mergers and acquisitions by 2004. Examples of these are acquisition of schemes of Alliance Mutual Fund by Birla Sun Life, Sun F&C Mutual Fund and PNB Mutual Fund by Principal Mutual Fund

Currently, the industry has crossed a landmark of Rs 27 lakh crores AUM and stands at Rs 27,04,699 crore as on 30th November, 2019 while still having high-growth prospects. The recent regulations by SEBI namely on the re-categorization alongside changes in expense ratios and commission structure have helped the industry to grow by allowing fair competition while continuing to protect investors’ interests.

The Investors shall invest only on the basis of information contained in the draft prospectus/KIM’

“The information, analysis and estimates contained herein are based on NBWS Research assessment and have been obtained from sources believed to be reliable. This document is meant for the use of the intended recipient only. This document, at best, represents NBWS Research opinion and is meant for general information only. NBWS Research, its directors, officers or employees shall not in any way be responsible for the contents stated herein. NBWS Research expressly disclaims any and all liabilities that may arise from information, errors or omissions in this connection. NBWS Research, its affiliates and their employees may from time to time hold units of mutual funds referred to herein. This report does not support to be an offer for purchase of this bond issue.”

“Mutual Fund Investments are subject to market risk. Please read the offer document carefully before Investing.”